How banks allowed HCC to escape from bank guarantees.

The Lavasa Story.

Lavasa was going to be a privately owned city close to Pune.

It was a private urban oasis where the writ of the owner ran large and it was going to maintain and run the city.

That this dream shattered is well known to everyone.

HCC (Hindustan Construction Company) had taken loans against which it had given bank guarantees worth 700 Million USD.

When the project fell into bad times, it went through the IBC route.

The project was sold for 1,800 Crores to a dubious company known as Darwin Platforms.

When the company was sold to Darwin Platforms, the Bank Guarantees issued by HCC, worth 7 Million USD, that is 5880 Crores were allowed to lapse by banks and reduced to zero. The banks never enforced these guarantees!

Now, the suitor, Darwin Platforms, itself is mired in legal cases of money laundering.

Darwin Platforms was to pay 1800 Crores in 9 years after the initial payment of 100 Crores and the rest in EMI’s over the next 9 years.

Lavasa is back to square one, with no owner right now other than the Resolution Professional.

Question is, why did the banks allow the Bank Guarantees issued by HCC to lapse?

Also, the question is, now that the resolution process that made the bank guarantees lapse itself has failed, why the banks are not approaching the courts to reinstate the bank guarantees?

After all 5880 Crores is not a small amount.

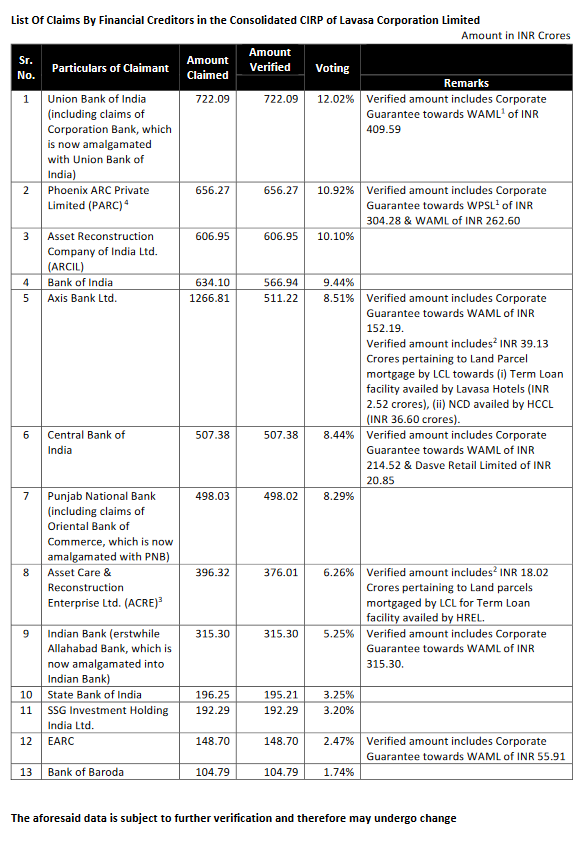

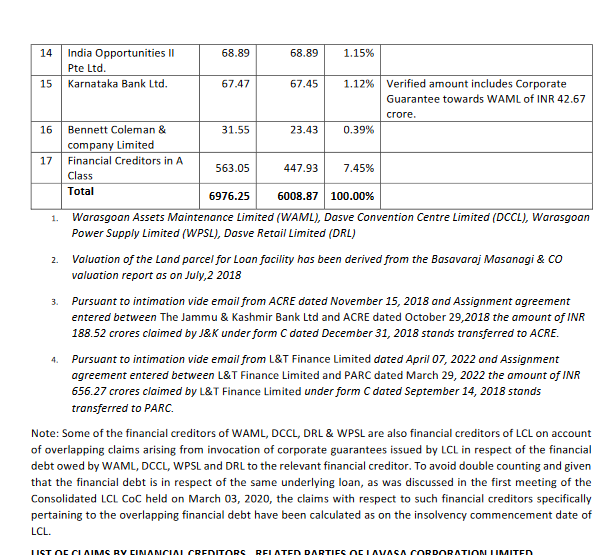

Who are the financial creditors to Lavasa? See the images

Once again, most of them are public sector banks, banks owned by Government of India, that is, we the people.

And when these banks lose money, Government diverts tax money to these banks to fill the holes in their balance sheets.

Further reading

How the Lavasa fell into bad times. Link Here.

How Lavasa was sold for 1800 Crores against a debt of 6000 Crores. Link Here

How the sole rescuer got thrown out of the debt resolution process. Link Here

How Lavasa Residents have turned into Slumdog Millionaires. Link Here